1031 Exchange Escrow Account: Complete Guide.

Introduction

A 1031 exchange escrow account plays a crucial role in real estate investment. It helps property owners defer capital gains taxes when selling one investment property and buying another. By holding proceeds safely, escrow accounts ensure compliance with IRS rules while allowing investors to reinvest fully into new properties.

What is a 1031 Exchange?

A 1031 exchange, under Section 1031 of the Internal Revenue Code, allows investors to defer paying capital gains tax when selling an investment property, provided the proceeds are used to purchase a “like-kind” property.

Key rules include:

- Property must be for business or investment purposes.

- Replacement property must be identified within 45 days.

- Purchase of replacement property must be completed within 180 days.

Role of the Escrow Account

A 1031 exchange escrow account is where the proceeds from the sale are held temporarily by a Qualified Intermediary (QI).

The seller cannot touch the money directly; if they do, it may void the tax deferral.

The escrow account ensures compliance with IRS rules by holding the funds safely until they are used to purchase the replacement property.

Often called a qualified escrow account or part of the exchange accommodation.

What is an Escrow Account in a 1031 Exchange?

A 1031 exchange escrow account is a special account managed by a Qualified Intermediary (QI). It temporarily holds proceeds from the sale of the original property until they are used to purchase the replacement property.

Important points:

- Funds cannot be accessed directly by the investor.

- Ensures IRS compliance for tax deferral.

- Often referred to as a qualified escrow account.

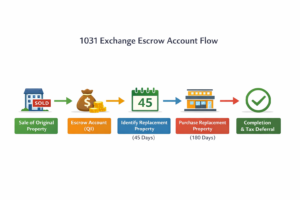

How a 1031 Exchange Escrow Account Works

- Sale of Original Property: Proceeds go directly into the escrow account managed by a QI.

- Identify Replacement Property: Investor identifies a new property within 45 days.

- Purchase Replacement Property: QI uses escrow funds to buy the replacement property within 180 days.

- Completion: Ownership is transferred, and capital gains taxes are deferred.

1031 Exchange Escrow Account

Benefits of Using a 1031 Exchange Escrow Account

- Tax Deferral: Postpone paying capital gains taxes.

- Full Investment Leverage: Reinvest all proceeds into a new property.

- Portfolio Growth: Upgrade or diversify real estate holdings.

- IRS Compliance: Funds held by a QI prevent accidental tax liabilities.

Important Considerations

- Qualified Intermediary Required: Investor cannot handle funds directly.

- Strict Deadlines: 45-day identification and 180-day purchase periods are mandatory.

- Escrow Fees: Some QIs charge fees for managing funds.

- Like-Kind Requirement: Replacement property must meet IRS criteria.

See Also 1031 exchange loan

Common Questions (FAQs)

Q1: Can I handle the funds myself in a 1031 exchange?

No. Funds must be held by a Qualified Intermediary to maintain tax-deferred status.

Q2: What happens if I miss the deadlines?

Failing the 45-day or 180-day deadlines can void the 1031 exchange, triggering immediate capital gains taxes.

Q3: Are escrow accounts insured?

Most escrow accounts are held in FDIC-insured accounts, but always confirm with the QI.

Q4: Can escrow accounts hold partial proceeds?

Yes, but any funds not used for the replacement property may become taxable.